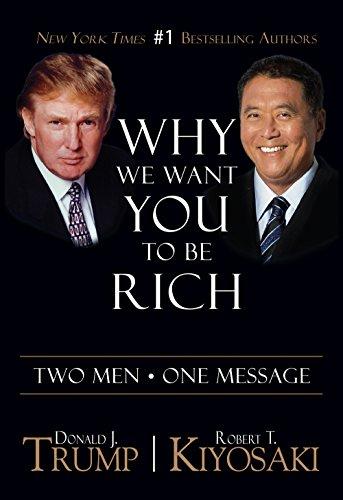

Why We Want You To Be Rich

8 min read ⌚

Two Men, One Message

At their first meeting, Kiyosaki said to Trump – I’m a millionaire, and you’re a billionaire, and that’s quite different.

Donald asked him – What’s the point of the argument when millions of people would trade places with you if they had the chance?

Robert replied: Being a millionaire is not a prerequisite for success.

Let’s say, you have inherited a house, and the price of the real estate has skyrocketed, but your yearly income is below $50k. It doesn’t matter that your net worth is well over a million when you can declare bankruptcy if you fall seriously ill and require medical treatment.

Nice analogy, let’s delve into it!

Who Should Read “Why We Want You To Be Rich”? And Why?

If you believe that rich people are afraid of seeing other people getting wealthy, you better think again.

This is not a video game, but the real world.

A better economy means more opportunities for people to get out of poverty, so becoming rich is in everyone’s best interest!

What’s the problem then?

The victim mentality is seeping into America, creating generations of underdogs who believe they have the right to the American Dream.

The world is changing at a rapid pace, and all the things that were once relevant are fading into obscurity, therefore “Why We Want You To Be Rich” is the book of the future.

About Donald J. Trump & Robert T. Kiyosaki

When Donald J. Trump wrote this book in 2006, nobody expected that he would become the 45th US President.

Apart from showcasing political prowess, no one can undermine his success in the real estate business. Many Americans see his entrepreneurial mindset as a way of bringing America to the top, as the world’s top economic and military superpower.

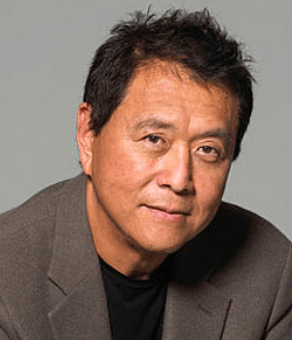

Robert T. Kiyosaki on the other end, is a well-known business teacher, author, and the founder of Rich Global LLC.

In his books, he zooms in on the need for conducting a full-scale financial education to heal the American economy.

Book Summary

Donald Trump & Robert Kiyosaki have one thing in common – the wits to make money. Both can be labeled as successful entrepreneurs who have a vision and make smart moves. They are also best-selling authors and persons who are fearful of America’s lack of financial education.

Before we take things to the next level, it’s vital to mention that there are three levels of financial advice:

- One for the poor – (the government will take care of me)

- One for the middle class – (work hard, save money, and invest wisely)

- One for the rich – (invest to win)

Moving forward, this book is seen as an inspiration to middle-class Americans, who choose to believe in the “American Dream” and are willing to take full control of their lives and themselves.

Here and there, you’ll find people talking about finances and how to increase the value of your assets, but no one gives any actionable advice. It stands to reason why you should consider altering your approach, but when it comes to money, nobody is willing to take any chances.

Transparency emerges as the new swipe at the face of misleading information!

Truthfully, people are not inclined to follow a certain agenda, without being absolutely sure that it will not backfire on them. And, because American society is not exactly financially literate, the US continues to increase its debt and lose market opportunities.

The once well-known Dream is coming to a halt, and giving more money to the hands of the poor only aggravates the problem.

Contrary to the socialist mindset, taxing the “Rich” and giving it to the poor is merely a death wish for the American Economy.

Let’s see why:

Donald Trump & Robert Kiyosaki voice concern about the enormous debt that continues to accumulate and it now exceeds the combined value of all the bonds and stocks, globally.

According to Trump, one of the obvious reasons is the nurturing of the victim mentality and the idea of entitlement!

The American economy will cripple if the needs of all people are addressed because the money accumulated through taxes cannot cover government spending!

If you have money problems, believe us when we say you are not the only one. If you want to become rich and create opportunities, then you must practice the craft of dealing with financial liabilities as they incur.

Apart from not yielding to fear, you also need to make smart moves under pressure and perform when things get rough. Every generation has its challenges, and yours is not excluded from that reality.

In the 20th century, we had stuff like The Great Depression, WW2, Communist Expansionism, etc. The antidote to this chaos was taking the safe route by going to school, finding a good job, and reaping all the benefits upon retirement.

This life trajectory is no longer an option, and you need to find another path!

To do that, you need financial intelligence. Kiyosaki describes it as the ability to prosper and stay with both feet on the ground when things go south. For example, he addresses the never-ending soar of energy prices, and why when energy prices go up, the country follows on this decline.

Robert Kiyosaki also mentions plowing back into the oil business because he gets 70% write-off + 15% depletion allowance upon investing.

The 90/10 Rule of Investing

If you think that putting up money into something is merely a risk-taking endeavor, then you surely are far from reaching success. Investing is not about calculating risks; it revolves around the process of taking the right actions that can bring profits.

Needless to say 10% of Americans own or possess 90% of the wealth, and the gap doesn’t seem to disappear.

Kiyosaki argues that currently, he is not a professional Golf player because he cannot fall into that 10% and the same goes for singing, NBA, you name it.

In other words, you need to choose the battle you can win!

Donald Trump follows up on this and says that being stubborn is an inevitable path to success.

Quitters don’t make it far, and never shall.

Some don’t want you to succeed, and they would rather stamp you out, but that’s not an excuse for backing down.

You might think that savers and investors pretty much follow the same rules, lean on the same logic, and make the same moves, but that’s not the case. Passive investors nurture a mindset that compels them to think and act in accordance with the motives listed below:

- Get out of debt

- Work hard

- Save money

- Diversify

- Invest in the long-term

The main difference between the rich, poor, and middle class is leverage. Investing and saving can never be put on an equal footing because one of them requires an excessive time frame to pay off, and you may have some clue about which one that is.

Investors are mainly cagey about sharing their secret sauce, unlike Donald and Robert who see the threat in leaving people to “rot” in poverty.

When we discuss investments, the questions you need to ask are:

- How do you reduce risk and increase returns?

- How do you find great investments?

- How do you know a good deal from a bad deal?

- How do you invest with less of your own money and more OPM (other people’s money)?

- How do you get the experience without risking money?

- How do you handle losses?

- How do you find good advisors?

But even when you have all the tricks in your pocket, if you don’t act in the face of fear, you cannot win.

In this summary, we try to make a distinction between active and passive investors and help you see the big picture as well. Probably, the most genuine depiction of how they differ is the fact that passive ones fear lacking money, while active ones see it as a challenge.

In addition, passive ones tend to choose more risk-free investments, while active ones opt for real-estate investments and business enhancement.

Previously we said something about leverage, and perhaps you cannot discern any meaning from it. However, leverage simply means the ability to achieve or do more with less.

It’s no wonder why we hear the slogan “Think Big” all the time. Have you ever seen a mediocre person who has achieved something extraordinary? No, because the mindset of that individual, keeps him/her in a state of chaos.

To sum it up, let’s list the five things you need to have in order to find yourself at the top of the heap:

- Me/You

- Leverage

- Control

- Creativity

- Expansion

The biggest dilemma of all that upsets the socialist class is – Why do the rich keep getting richer?

First and foremost, it’s much easier to invest when you have the resources to do so. However, many lottery winners have declared bankruptcy in a three-year time frame after winning millions of dollars. That shows – giving money to people without financial education is not going to get them out of poverty.

The truth of the matter is that you don’t need to bail out of school, nor to quit your 40-hour job but shift your perception of life.

There are a number of games or let’s say extracellular activities that can stimulate parts of your brain to make better decisions. This particularly applies to finances and managing money in general.

Last but not least, it’s much easier to succeed if you have a good role model.

Donald Trump singles out his father as the main figure who helped him to succeed, while Robert gives credit to the “Rich Dad” across the street who taught him so many things.

Now the ball is on your side of the court.

Keep learning, keep expanding otherwise you’ll get the short end of the stick.

Key Lessons from “Why We Want You To Be Rich”

1. Find out whether your father has an entrepreneurial mindset

2. Be prepared to face the hurdles along the way

3. Tackle the comfort

Find out whether your role model has an entrepreneurial mindset

An old adage says – there’s freedom in manual labor and we agree on that. There’s something profound about providing for your family and doing the hard work.

Nonetheless, the main issue is not the job itself, but the environmental demands.

If you prefer to keep administrators and executors out of your life, then you must educate yourself, financially.

Be prepared to face the hurdles along the way

You might think, well how to change my mindset if I don’t have any money, to begin with? How can I become a business owner or an investor if there’s nothing in my bank account?

Transition commences not when you have the chance to throw money around or squander profits.

As a matter of fact, it starts when the right attitude is in place, and hence the world will open up to you!

Tackle the comfort

If you don’t feel like paddling to new unexplored shores, then no one can help you. Staying in one spot and waiting for a miracle to emerge is not something that is realistic.

So, you have to move beyond the comfort zone and embrace the uncertainty, or dive deep into the unknown should you prefer.

Like this summary? We’d Like to invite you to download our free 12 min app, for more amazing summaries and audiobooks.

“Why We Want You To Be Rich Quotes”

Do not neglect your life skills, which should include a healthy dose of financial education. Share on X Getting back to the difference between a saver and an investor, there is one word that separates them and that word is leverage. One definition of leverage is the ability to do more with less. Share on X Give yourself a little freedom develop into something or someone you'd actually like to be. Share on X I have learned that what is essential can sometimes be invisible to the eye. That’s where discernment comes in. Share on X There are no guarantees, but being ready sure beats being taken by surprise. Share on XOur Critical Review

Whenever someone mentions either Robert T. Kiyosaki or Donald Trump, the first thing that comes into our minds is money.

Well, that’s one way to phrase it, but there’s another way – Combativeness and broadness.

In this book, you’ll catch a glimpse of all the habits and abilities you must nurture in order to come out victorious.

One thing is for certain – it’s not going to be easy!

Emir is the Head of Marketing at 12min. In his spare time, he loves to meditate and play soccer.